Growing revenue and profit has always been the chicken or the egg type discussion.

It is possible to do both by creating a deal desk.

We’ve done it at a public SaaS company consistently every quarter for 5 years.

Deal desk not only helped our company’s valuation grow from $1 billion to $5 billion in 5 years, but it also helped us get promoted faster.

And you can create your own deal desk with similar results. 😉

Let’s dive right in.

What you need

To start you’ll need your most up-to-date customer data. Specific items you’ll need for each customer are:

- List of all services your company sells

- Cost-to-serve data that supports all the services your company sells

- Financial guardrails from leadership tied to the long-term plan

Getting all this info will require some serious business partnering.

But that’s the best part.

You’ll become an expert at what your company sells, how it supports these services internally, and connect with A TON of people across multiple departments. 💃

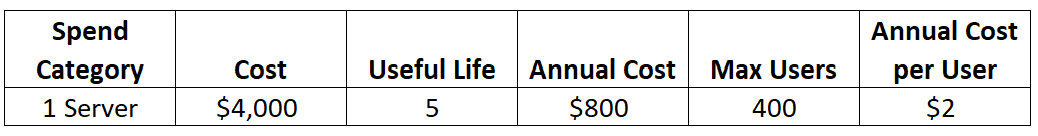

Step 1: Understand what you sell to determine cost-to-serve

SaaS isn’t something that’s manufactured. It’s a combination of servers, code, and people support.

Figure out what specific services your company offers its customers.

Then go DEEP into the weeds. Talk to R&D / Customer Support and ask these questions…

- What triggers more spending on servers/cloud computing resources?

- What drives activity for support teams every day?

- How do vendors charge us for 3rd Party software/services to support our services?

What you’ll find is there are different drivers for every spend area and service offered. Things like customer count, user count, case count, and transactional dollars could all be major activity drivers.

Now take the costs from various departments and divide them by the activity drivers. This will give you CTS (cost-to-serve) for each.

Then apply this CTS metric to the various products you have to understand profitability at different price points.

Now you have a handle on how profitable certain services are depending on their selling price.

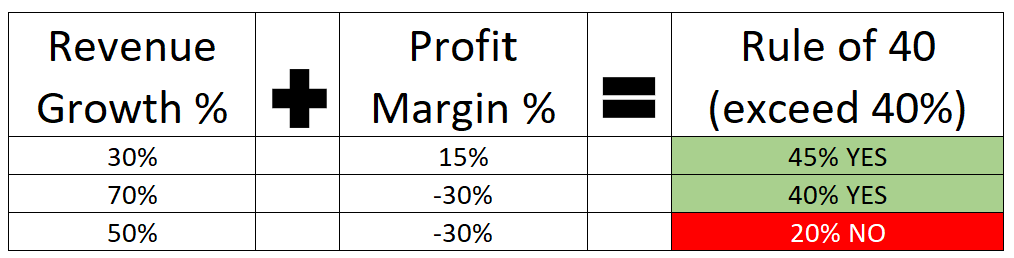

Step 2: Create revenue and profit guardrails

This requires help from leadership.

Where is the company today and where do we want it to be 1 year, 5 years from now?

SaaS companies target a 70% gross margin and try to show expansion as total revenue grows. And revenue growth very much depends on the stage of the company. Some grow 5X, some grow 20%.

Sometimes the company strategy will involve different revenue growth and profit targets for various products and regions. That makes total sense. The trick is understanding the mix of all these areas so there are no surprises.

Sometimes the rule of 40 comes into place when building these guardrails.

Once these targets are understood, you’ll have the guardrails in place to create deal approval thresholds to ensure the company meets these targets.

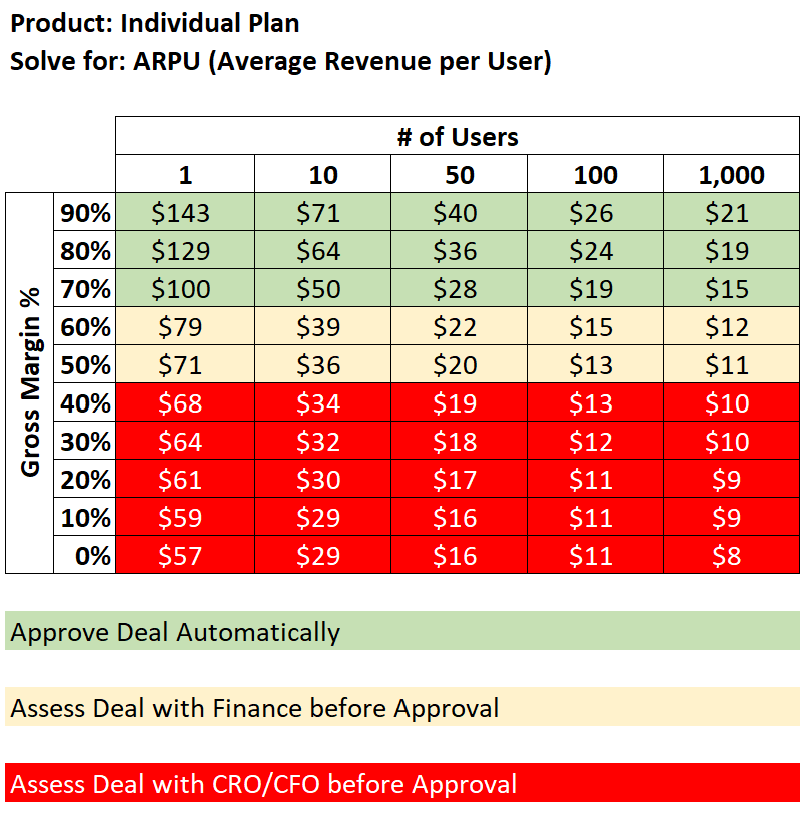

Step 3: Communicate acceptable selling prices to Sales

Sales should be given the ability to sell quickly with data-driven confidence.

To do this provide them with a one-pager cheat sheet they can reference.

A SaaS cheat sheet could include ARPU (average revenue per user), number of users, product, and GM% (gross margin).

For more automation build this logic into your CRM tool.

Approval thresholds can be triggered by ARPU which you can determine by using the analysis that feeds the cheat sheet. Do this by product and region.

You should also track closed-won customers throughout the quarter to understand where revenue and gross margin are likely headed.

Do all of this and you will have a line of sight into next quarter’s revenue and gross margin performance.

This type of analysis is like giving your career rocket fuel. 🚀

Conclusion

You can now feel confident that sales will be selling profitable deals.

Your CFO will feel very good about this too!

Not every company has this data-driven confidence to back up its financial goals.

The deal desk is a great way to get into business partnering too. You’ll work with sales, financial systems, rev ops, technical operations, R&D, and regional finance leads.

You can also stand up a commercial finance team with members in each major region.

How about you? How do you feel about building your own deal desk?

Let us know and we’ll be sure to share your thoughts in our next posts!

Have fun making an impact on your business and your career.

Cheers,

Drew & Yarty

PS: This post is 100% human-made