Has your profit forecast been way off due to over or underspending from marketing?

Ours have, and it generates that sinking feeling in your stomach.

We’ve done over one hundred profit forecasts in our career and figured out how to accurately manage marketing spend.

Say goodbye to that sinking feeling.

Your path to your next promotion just became clearer and shorter. 🙂

Let’s dive right in.

What you need

There are three key things that go into accurate marketing spend forecasts:

- Purchase Order (PO) approach to spend approval

- Marketing business partner

- The weekly process to review what’s spent

The above is super simple when stood up.

And not only does this help with accuracy, but it also helps you proactively INCREASE or DECREASE marketing spend if your quarterly profit is trending in the wrong direction.

This is the type of process that also works well with CAPEX (capital expenditures), another area you can improve which will speed up your promotion!

Step 1: Leverage the PO approval process

The great thing about a PO is it can predict the future as long as the information within it is accurate and complete.

Vital information to capture on a PO are:

- Service date (aka when spending takes place)

- Department

- Account

- Amount raised

- Amount spent

- Approver

- Requester

Make sure PO’s are raised and approved BEFORE the quarter starts. That forces a plan to be in place and helps avoid surprises with both requestors and approvers.

This information should exist in your financial system with approval thresholds automated to maximize communication and audit trails.

Another tip is to review these PO’s with accounting to understand any special accounting accruals that may impact cash versus expense handling. Again making your profit forecast more accurate.

Now you have a framework for marketing spend data and are one-third of the way to sleeping better at night!

Step 2: Assign a marketing business partner

Having one finance business partner in the day-to-day marketing world is critical.

That person will build trust, help with number crunching, and ensure the marketing activities are connected with spending expectations set forth by the profit forecast.

Always remember that a good finance business partner reduces the time spent in spreadsheets. The last thing marketers want is to have hours of meetings going line by line in expense details.

This business partner lays the foundation for the third and final piece, the process.

Step 3: Create a weekly review process

We know, we said spend LESS time in spreadsheets. So why would we review this spending weekly?

This process should take less than 30 minutes each week and can be pulled from your financial system automatically.

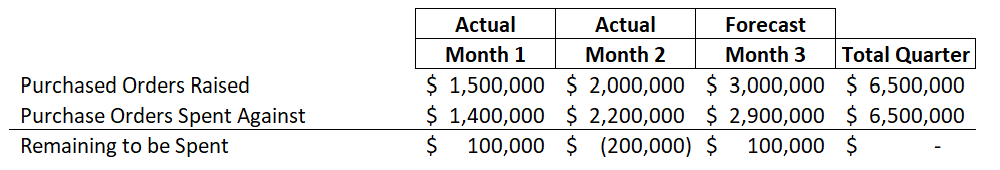

You already have all PO’s raised and approved at the beginning of the quarter. Now you are just checking to confirm the money has been spent on those PO items.

Sometimes months can be lumpy due to timing. That’s ok as long as you manage to the quarter.

This process proactively helps with monthly variance analysis too.

Conclusion: Congrats, you can now accurately predict marketing spend

Better sleep, happier bosses, and faster promotions are in your future!

Marketing spend can be EXTREMELY unpredictable if no financial oversight is given.

This approach isn’t rocket science, but not many companies have this type of financial rigor built into their forecasting process.

And when you roll out this process everyone involved will thank you over and over again.

Why?

Because your marketers will be able to focus on marketing, NOT spreadsheets, and your CFO will feel comfortable that marketing spend is under control.

Taking it a step further, you can start analyzing marketing spend to see how it impacts customer and revenue growth.

Analysis like Customer Lifetime Value helps drive long-term company growth and even more opportunities for future promotions!

Have fun making an impact on your business and your career!

Cheers,

Drew & Yarty

PS: This post is 100% human-made